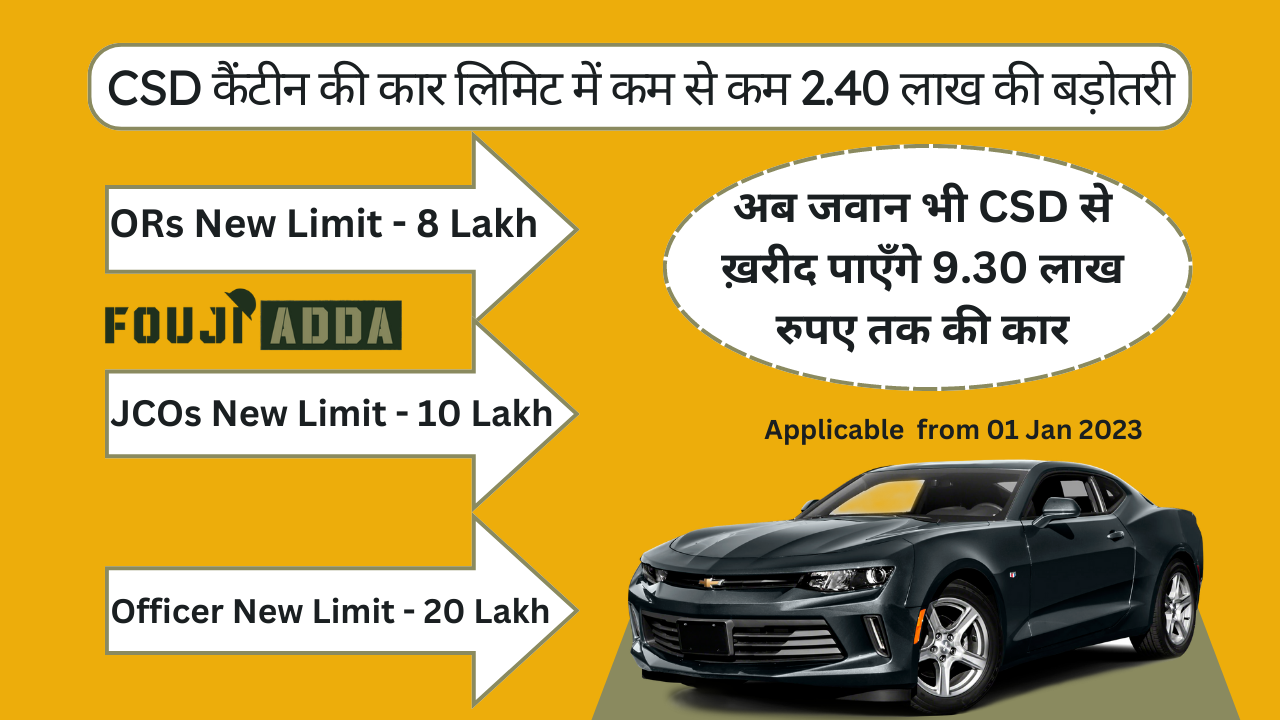

A limit as per rank of defense personnel has been made to purchase cars through CSD canteen. According to the old limit, there were many such cars which JCOs & other rank defense personnel could not purchase. To solve this problem, on 30 November 2022, the Quarter Master General Branch of the Ministry of Defense has issued a letter informing about the new policy of car purchase from CSD canteen. According to the new rule of CSD canteen, now defense personnel will be able to purchase a higher priced car. This policy will be applicable from 1 January 2023.

According to the new rule, now defense personnel of pay level 3A to 5 rank will be able to buy cars up to Rs 8 lakh from CSD canteen. Taxes are not included in this limit. If we talk about prices with tax, then the car whose price in CSD canteen is about 9.20 lakh rupees, can be purchased by defence personnel of pay level 3A to 5. In the old policy of CSD canteen, this limit was Rs.6 lakhs and only the defense personnel of this pay level could buy the car whose price in CSD canteen was up to Rs.6.95 lakhs including taxes.

Defense personnel of the rank of Sep to Havildar come in this pay level or defense personnel of the same rank of Navy and Air Force come in it. Before this rule, NB/SUB who come in Pay Level 6, were also included in this category. But in the new car policy of CSD Canteen, they are included along with JCO. Now defense personnel of NB/SUB or equivalent rank in Navy and Air Force, can purchase a car as per the limit of JCO rank.

The rank of NB/SUB to Subedar Major or defense personnel of the same rank in Navy and Air Force falls in this pay level. As per the new policy, defense personnel of this pay level can buy cars up to Rs 10 lakh from CSD canteens. Taxes are not included in this limit. If we talk with tax, then the car whose price in CSD canteen is about 11.50 lakh rupees, can be purchase the car from CSD canteen.

Earlier this limit was 7 lakh rupees without tax and the car whose price used to be around 8.05 lakh in CSD canteen, the same car could be bought by the defense persons of this category. According to the new rule of CSD canteen, now SUVs like XUV, TATA Nexon, Hyundai Venue, Creta, Vitara breezeza can also be purchased by JCOs.

After the new rule of CSD canteen, defense personnel of officer rank can buy cars up to Rs 20 lakh from CSD canteen. Taxes are not included in this limit. If we talk price with tax, then the car up to Rs 23 lakh can be bought by the officer from CSD. Earlier this limit was Rs 15 lakh without tax. Officers can buy a car from the CSD canteen every 8 years. There is no limit on the number of cars a defense person of officer rank can buy.

You can check the limits as per old and new CSD car policy in the table given below.

| Pay Level/Rank | Old Limit without Tax | New Limit Without Tax |

| Pay Level 3 - 5 (ORs) | 6 Lakh | 8 Lakh |

| Pay Level 6 - 9 (JCOs) | 7 Lakh | 10 Lakh |

| Pay Level 10 - 18 (Officer) | 15 Lakh | 20 Lakh |

Many defense persons will get confused between tax and tax-free price in CSD canteens. Because most of thinks that tax is not applicable, then why are they telling the price with tax. For your information, let us tell you that while buying a car from CSD canteen, the defense person gets 50% discount in GST and has to pay 50% GST. Let us understand this by taking an example. If the basic price of a car is 8 lakh rupees in which no GST is included. Let's assume that 30% GST is levied on that car, then 30% GST will be levied on the cost of that car in civil which will be 2.40 lakhs. After applying GST, the cost of that car in civil will be 8 lakhs + 2.40 lakhs = 10.40 lakhs.

In the same CSD canteen, 1.20 lakh GST will be charged on that car according to 15% GST, then after tax the cost of that car in CSD canteen will be 8 lakh + 1.20 lakh = 9.20 lakh. In this way, the car is cheaper for the defense person through the CSD canteen. However, apart from this, there are some taxes which we have not mentioned here. That's why in the limit given above, when we have talked about without tax, then the basic cost of the car has been talked about. After which GST will be imposed on it and approximate CSD price of that car will come.

For your convenience, the photo of the new car policy of CSD Canteen is given below.

This was the new policy to buy car from CSD canteen. I hope you have understood the new rule of CSD canteen very well from this post. If you liked this post then click on the like button above. Click here to get Defense Welfare News on Whatsapp.