The dearness allowance (DA) of central government employees has recently been increased by 4%, reaching 50%. This means that Central Government employees will receive a 4% increase in their DA. Pensioners of the Central Government will also benefit from this increase, which will help to bear the impact of price rises.

As a central government employee, you are most likely aware of the importance of the Dearness Allowance (DA) in your compensation structure. The DA is a dynamic element that adjusts to the ever-changing cost of living. The 7th Central Pay Commission has made provisions for increasing the allowances when the DA crosses 50%. However, we want to know what happens when the DA reaches the critical 50% touch point, and how this increased DA impacts your other allowances and financial benefits as a central government employee.

In this article, we will give the answers to the raised questions, so stay tuned with us till the end.

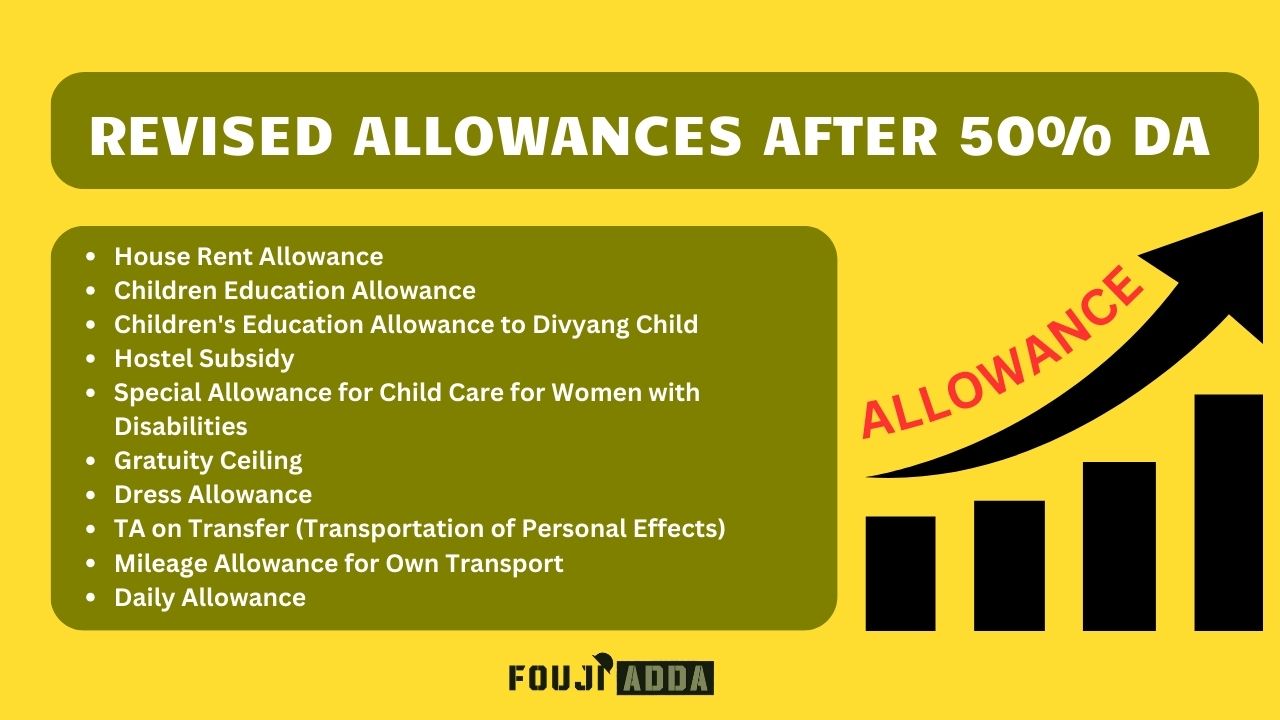

When DA reaches 50% then the other allowance also changes/revised as per the recommendation of the 7th pay commission. The other allowance that gets revised is given below:

The rates for HRA had been revised to 27%, 18%, and 9% of Basic Pay in X, Y, and Z cities when DA crossed 25%. Additionally, HRA rates would have been revised to 30%, 20%, and 10% of basic pay in X, Y, and Z cities when DA reaches 50%. These allowances have been revised as per the 7th CPC recommendation. No separate order is required to revise this allowance as the government has already accepted the recommendation.

The HRA percentage will increase based on the table below when DA reaches 50%.

| City Type | HRA from 1.1.2016 | HRA (When DA reached 25%) | HRA (When DA reaches 50%) |

| X | 24% | 27% | 30% |

| Y | 16% | 18% | 20% |

| Z | 8% | 9% | 10% |

The Children's Education Allowance will be increased by 25% every time the Dearness Allowance (DA) reaches 50%.

| Component | Present Rate | After DA Reaches 50% |

| Children Education Allowance | Rs. 2,250 /- per month | Rs. 2812.5/- per month |

Every time DA reaches 50%, the Children's Education Allowance for Divyang Child will be increased by 25%.

| Component | Present Rate | After DA Reaches 50% |

| CEA to to Divyang Child | Rs. 4500 /- per month | Rs. 5625/- per month |

The subsidy for hostels will be increased by 25% each time the Dearness Allowance (DA) reaches 50%.

| Component | Present Rate | After DA Reaches 50% |

| Hostel Subsidy | Rs. 6,750 /- per month | Rs. 8437.5/- per month |

Special Allowance for Child Care for Women with Disabilities will be increased by 25% every time DA reaches 50%.

| Component | Present Rate | After DA Reaches 50% |

| Special Allowance for Child Care | Rs 3000 /- per month | Rs 3750/- per month |

Whenever the Dearness Allowance (DA) increases by 50%, the Gratuity Ceiling will be raised by 25%.

| Maximum Gratuity Ceiling at Present | Maximum Ceiling when DA Rises by 50% |

| Rs 20 Lakhs | Rs 25 Lakhs |

The Dress Allowance categories' rates increase by 25% whenever DA rises by 50%.

| Employee Category | Present Rate (per annum in Rs.) |

After, DA Reaches 50% (per annum in Rs.) |

| Special Protection Group (SPG) Operational | 27,800 | 34,750 |

| Special Protection Group (SPG) Non-operational | 21,225 | 26,531 |

| Officers of Army/IAF/Navy/CAPFS/CPOs RPF/RPSF/IPS/Coast Guard | 20,000 | 25,000 |

| MNS Officers, Officers of DANIPS/ACP of Delhi Police/Other Union Territories | 15,000 | 18,750 |

| Defense personnel in JCOs & ORs ranks, Executive Staff of Customs, Central Excise and Narcotics Department, etc. (Both in summer and summer cum winter) | 10,000 | 12,500 |

| Other Categories of Staff | 5,000 | 6,250 |

| Nurses | Rs. 1800 /- per month | Rs. 2,250/- per month |

When the DA reaches 50%, the rates listed below will be increased by 25%.

|

Pay Level |

By Train/Steamer |

By Road |

|

12 and above |

6000 Kg by goods train/4 wheeler wagon/1 double container |

Rs. 50/ - per km |

|

6 to 11 |

6000 Kg by goods train/4 wheeler wagon / 1 single container |

Rs. 50/ - per km |

|

5 |

3000 kg |

Rs. 25/ - per km |

|

4 and below |

1500 kg |

Rs. 15/ - per km |

If rates are not specified by the Directorate of Transport, the Mileage Allowance for own Transport should be increased by 25% when DA exceeds 50%.

|

Mode of Transport |

Present Rate |

After DA Reaches 50% |

|---|---|---|

|

For Journeys in Own Car/Taxi |

Rs. 24/ - per km |

Rs. 30/ - per km |

|

For Journeys by Auto Rickshaw/Own Scooter etc. |

Rs. 12/ - per km |

Rs. 15/ - per km |

The rates for reimbursement of the following expenses will increase by 25% when DA rises by 50%.

| Pay Level | Entitlement |

|---|---|

| Pay Level 14 & above | The reimbursement for hotel accommodation or guest house is allowed up to Rs. 7,500 per day. Reimbursement will be provided for AC taxi charges incurred during official travel within the city. Employees can claim reimbursement for food bills incurred during official travel, subject to a maximum limit of Rs. 1,200/- per day. |

| Pay Levels 12 and 13 | The reimbursement for hotel accommodation or guest house is up to Rs. 4,500 per day. For intra-city travel, you can claim reimbursement of up to 50 km per day for AC taxi charges. Reimbursement is available for food bills that do not exceed Rs. 1,000 per day. |

| Pay Levels 9 to 11 | Reimbursement of up to Rs. 2,250 per day for hotel accommodation or guest house expenses. Non-AC taxi charges up to Rs. 338 per day are reimbursed for intra-city travel. Reimbursement is allowed for food bills that do not exceed Rs. 900/- per day. |

| Pay Levels 6 to 8 | Reimbursement of hotel accommodation or guest house expenses up to a maximum of Rs. 750 per day. Non-AC taxi charges up to Rs. 225 /- per day are reimbursed for city travel. Food bills can be reimbursed up to a maximum of Rs. 800 per day. |

| Pay Levels 5 and below | Reimbursement is provided for hotel accommodation or guest house expenses of up to Rs. 450 per day. For travel within the city, non-AC taxi charges up to Rs. 113/- per day will be reimbursed. Employees can claim reimbursement for food bills that do not exceed Rs. 500 per day. |

For claims up to level 8, the ceiling amount may be paid without the need for vouchers, but only against self-certified claims. The self-certified claim should specify the duration of stay, the name of the residence, and other relevant details.

Moreover, for stays in Class 'X' cities, the maximum amount for all employees up to Level 8 is Rs. 1,000 per day, but only if relevant vouchers are produced. The maximum reimbursement for hotel expenses will increase by 25 percent whenever DA increases by 50 percent.

For levels 8 and below, you can get reimbursed for staying accommodation charges without having to produce vouchers, as long as you self-certify your claim and mention the period of travel, vehicle number, etc. The claim amount can be paid up to the ceiling limit.

For levels 11 and below, the ceiling limit will increase by 25% whenever the DA (Dearness Allowance) increases by 50%.

If you travel on foot, you can get an allowance of Rs. 12/- per kilometer traveled on foot, in addition to your other allowances. This rate will also increase by 25% whenever the DA increases by 50%.

There might be no separate reimbursement of meal bills. Instead, you will receive a lump sum amount as per the table below. Since the idea of compensation has been performed away with, no vouchers might be required.

|

Pay Level |

Entitlement |

After DA Reaches 50% |

|---|---|---|

|

14 and above |

Maximum limit of Rs. 1,200/- per day |

Maximum limit of Rs. 1,500/- per day |

|

12 and 13 |

Maximum limit of Rs. 1,000 per day |

Maximum limit of Rs. 1,250 per day |

|

9 to 11 |

Maximum limit of Rs. 900/- per day |

Maximum limit of Rs. 1,125/- per day |

|

6 to 8 |

Maximum limit of Rs. 800 per day |

Maximum limit of Rs. 1000 per day |

|

5 and below |

Maximum limit of Rs. 500 per day |

Maximum limit of Rs. 625 per day |

This methodology aligns with that followed by Indian Railways at present, with suitable enhancement of rates. It means that you will receive a fixed amount of money to cover your food expenses, which will increase by 25 percent whenever DA increases by 50 percent.

When the Dearness Allowance (DA) reaches 50 percent, other related allowances such as house rent allowance, daily allowance, gratuity ceiling, and hostel subsidy will also increase. This is because these allowances are connected to the DA, and as the DA increases, they also increase.

The pay commission rule states that once the DA reaches 50%, it merges with the basic salary and starts calculating from zero.

DA (Dearness Allowance) is a cost-of-living adjustment for public sector employees, while HRA (House Rent Allowance) is a component of an employee's salary that assists them in meeting their housing needs.

DA is revised biannually based on the cost-of-living index.

Dearness Allowance (DA) is taxable income and is included in the total income of an individual. It follows the same taxation rules as other salary components. If received from an employee's salary, it forms gross income.