The SBI Shaurya Credit Card is specifically designed to honor the bravery and dedication of Indian armed forces personnel. Eligibility for the SBI Shaurya Credit Card is extended to individuals who are currently serving in the Indian Army, Navy, Air Force, Coast Guard, Paramilitary, or Assam Rifles. The card offers a range of benefits including special discounts, cashback on specific categories, and exclusive privileges tailored to the needs of armed forces personnel like SBI DSP account. This unique credit card not only serves as a financial tool but also as a token of appreciation for the sacrifices made by these individuals in the line of duty.

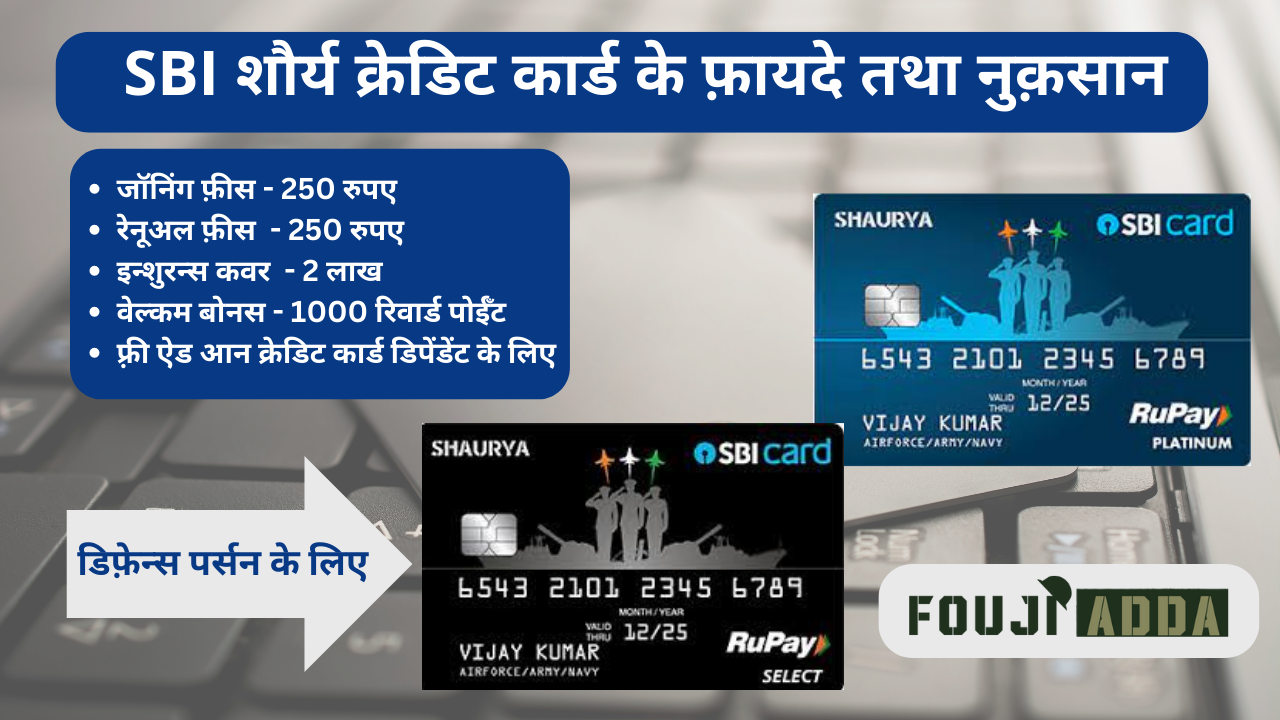

The annual fee for Shaurya Credit Card is Rs 250, which is charged by SBI Bank at the time of card issuance. Initially when the Shaurya Credit Card was launched by SBI Card, the annual fee for the Shaurya Credit Card was zero. After May 1, 2021, the annual fee for Shaurya Credit Card was increased to Rs 250, which is still continuous.

Apart from the annual fee, there is a renewal fee of Rs 250, which the Shaurya Credit Card holder has to pay every year. But if you spend 50000 rupees or more money using credit card in a year, then the renewal fee is waived off, Which means you do not have to pay the renewal fee.

Now let's talk about the benefits of Shaurya Credit Card.

The fee and charges for SBI Shaurya credit card is given below in the table.

| Type of Fee | Amount |

|---|---|

| Joining Fee | Rs 250 |

| Renewal Fee | Rs 250 |

| Finance Charges | Up to 3.50% per month |

| Card replacement fee | Rs 100 |

| Cash advance fee | 2.5% of the transaction amount (subjected to a minimum of Rs.300) |

| Cash advance limit | Maximum 80% of the credit limit |

| Minimum amount due | 5% of the total outstanding amount |

| Overlimit fee | 2.5% of the amount subject to a minimum of Rs.500. |

| Reward redemption fee | Rs.99 |

SBI Shaurya Credit Card does not have a fixed limit. The credit card limit depends on the net salary and credit score of the defense person. If the credit score and salary of the defense person is good then he/she can easily get good limits. As the defense person uses the credit card, the bank increases the Shaurya credit card limit after a few months.

Apart from this, Shaurya Credit Card holders can also apply for Add on Card. That is, the card holder can also take a credit card for his parent, spouse, or sibling who is above 18 years of age. Add - on Credit Card limit is given from Shaurya Credit Card only. For example, if the limit of a Shaurya Credit Card is Rs.50,000, then that limit is divided with the Add on card and the total limit of both the cards remains Rs.50,000. No charge has to be paid for add on card.

To reach the customer care services for the SBI Shaurya Credit Card, you can dial the number 39 02 02 02, making sure to prefix it with your local STD code. Alternatively, you can call 1860 180 1290. These dedicated helpline numbers are designed to assist you with any queries, concerns, or assistance you might require related to your SBI Shaurya Credit Card. The customer care team is readily available to provide guidance and support, ensuring a seamless and convenient experience for all cardholders.

No, the Shaurya Credit Card is not free for Defence personnel. Defence personnel are required to pay a joining fee of Rs 250. However, it was free before May 1, 2021.

No, lounge access is not available with the SBI Shaurya Credit Card for both domestic and international travelers.

To increase your credit limit on the SBI Shaurya card, you can contact the SBI Card helpline at 39 02 02 02 (prefix STD code) or 1860 180 1290. Connect with customer care representative to determine if you qualify for an increase in your credit limit.

The value of a reward point in SBI Shaurya credit card is 25 paise. This signifies that 4 reward points are equivalent to Rs 1.

You can dial 39 02 02 02 (prefix local STD code) or 1860 180 1290 for assistance and inquiries related to the SBI Shaurya credit card.

The SBI Shaurya Credit Card is considered the best for army personnel. This card is specifically designed for defense personnel and offers features such as 5X reward points on CSD shopping, a complimentary personal accident insurance cover of Rs 2 lakh, and a low joining and renewal fee.

The main benefits of the SBI Shaurya Credit Card for defense personnel are insurance cover of Rs 2 lakh and extra reward points on bill payments at CSD canteens. Both these benefits are not available in Basic Credit Card. These benefits are available in premium credit cards that have higher joining fees and annual fees. These were the benefits of Shaurya Credit.