In today's fast-paced world, financial stability and security are paramount, especially for those serving in the armed forces. The DSP account, whose full form is Defence Salary Package, encompasses a range of tailored financial solutions and exclusive benefits for military personnel. In this article, we delve into the various benefits and features of the SBI DSP account, shedding light on why it stands as a beacon of support and reliability for our esteemed defense personnel.

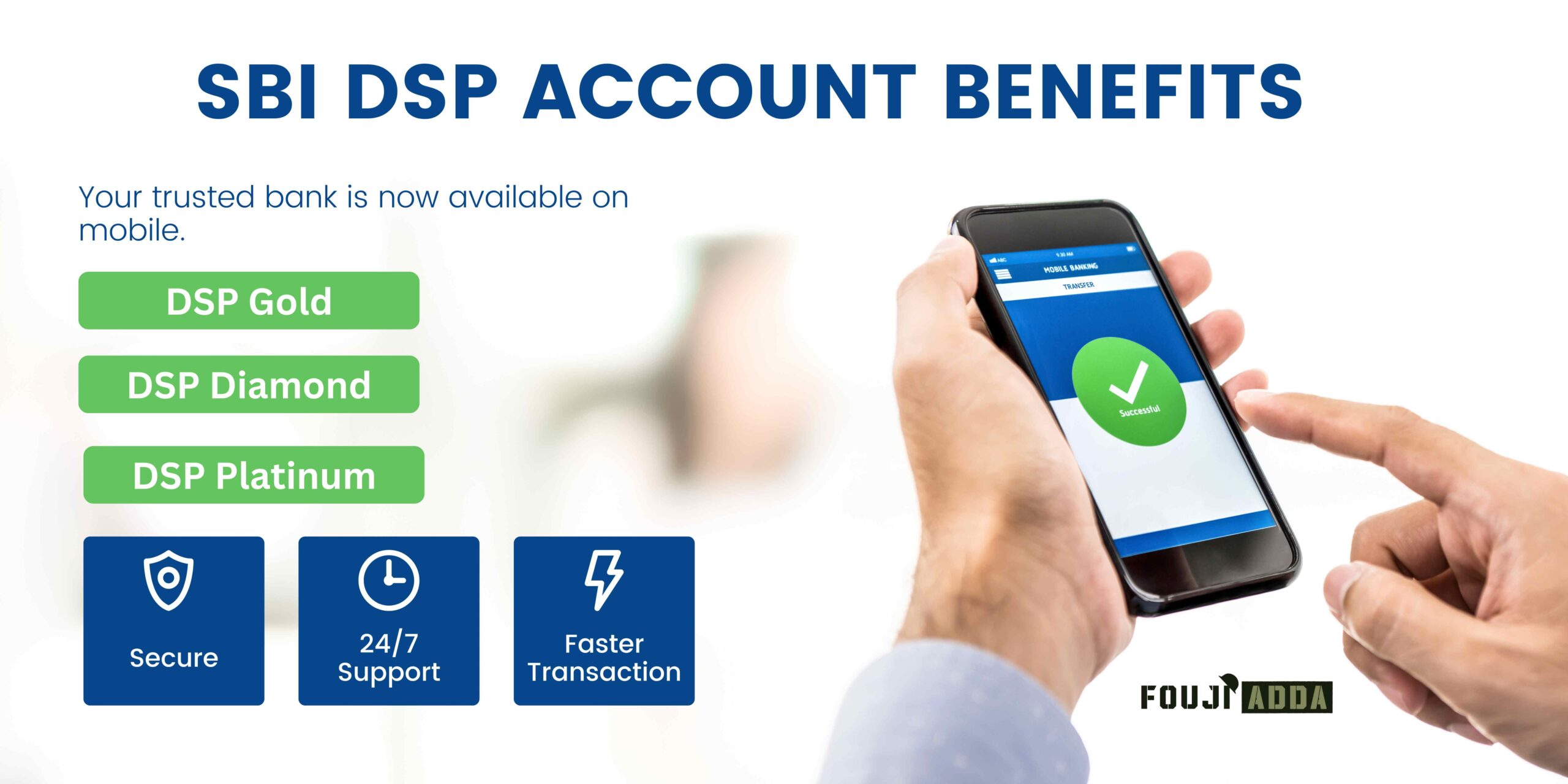

After the implementation of the Defense Salary Package, the entire salary of the army personnel is credited in their direct account. A total of 11 public and private banks offer the facility of Defense Salary Package but SBI Bank gives more benefits to the Defense Person in the DSP account. This is the reason that most of the DSP accounts are also in SBI Bank. DSP accounts of other banks do not have the same facilities as SBI Bank.

The SBI Gold DSP account caters specifically to Junior Commissioned Officers (JCOs) and Other Ranks (ORs) in the Indian Army. Designed to meet their unique financial needs, it offers exclusive benefits such as special overdraft facilities, preferential loan interest rates, waivers on service charges, personalized banking services, and comprehensive insurance coverage for the account holder and their family members. SBI Gold DSP account benefits are covered in details in the next part of this article.

The Diamond DSP Account is tailored for officers holding the ranks of Lieutenant, Captain, and Major in the armed forces. Offering a suite of premium banking services, this account is designed to match the unique financial needs and aspirations of these esteemed officers. With features such as higher transaction limits, exclusive loan schemes at preferential interest rates, complimentary multi-city chequebooks, and priority services at branches, the Diamond DSP Account provides a seamless and elevated banking experience.

The Platinum DSP Account caters to officers holding higher ranks such as Lt. Colonel, Colonel, Brigadier, Major General, Lt. General, and General in the armed forces, offering an unparalleled banking experience.

For your information, let us tell you that there are certain terms and conditions in the benefits of numbers 10 to 15, which are very necessary to fulfill. We will cover all these benefits one by one in the post so that you understand these benefits well. Ex-servicemen can also open a DSP account in which they do not get the facility of SBI Express personal loan, overdraft facility and insurance. You can see the details of the benefits of ex-servicemen in SBI Defense Salary Packages account here.