The defense person need to do the construction of the new house during service or after retirement or he buys a ready-to-move flat or house. This is a high value purchase in the life of the defense person. That's why most of the time, he definitely takes home loan from the bank. Because the interest rate of home loan is also low & affordable compared to other loans and interest subsidy of Rs 2.67 lakh is also given under PM Awas Yojana. We will talk about the subsidy of PM Awas Yojana in detail in another post.

It is also known that most of the defense person's salary accounts are in SBI Bank which is known as DSP account. That's why maximum defense individuals prefer to take a home loan from SBI Bank itself.

In this post, we will talk about the home loan given by SBI Bank to the Defense Person only which is known as SBI Shaurya Home Loan. First of all let's talk about who can apply for SBI Shaurya Home Loan.

SBI Shaurya Home Loan Eligibility

- Serving Persons of Indian Armed Forces, can apply for Shaurya Home Loan.

- The minimum age for home loan is 18 years and the maximum age is 75 years.

Benefits of SBI Shaurya Home Loan

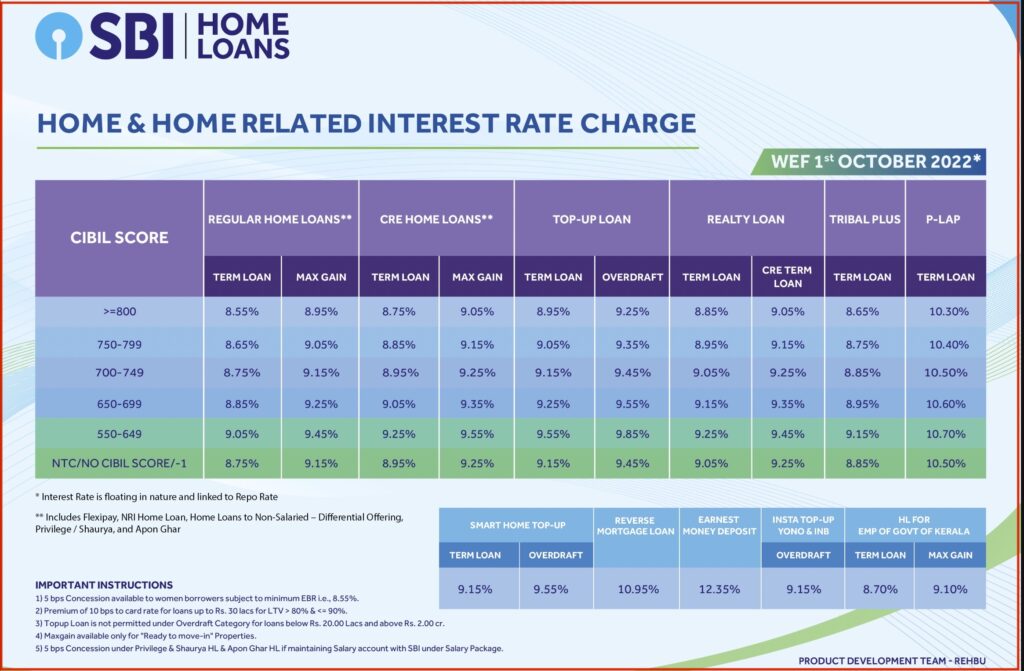

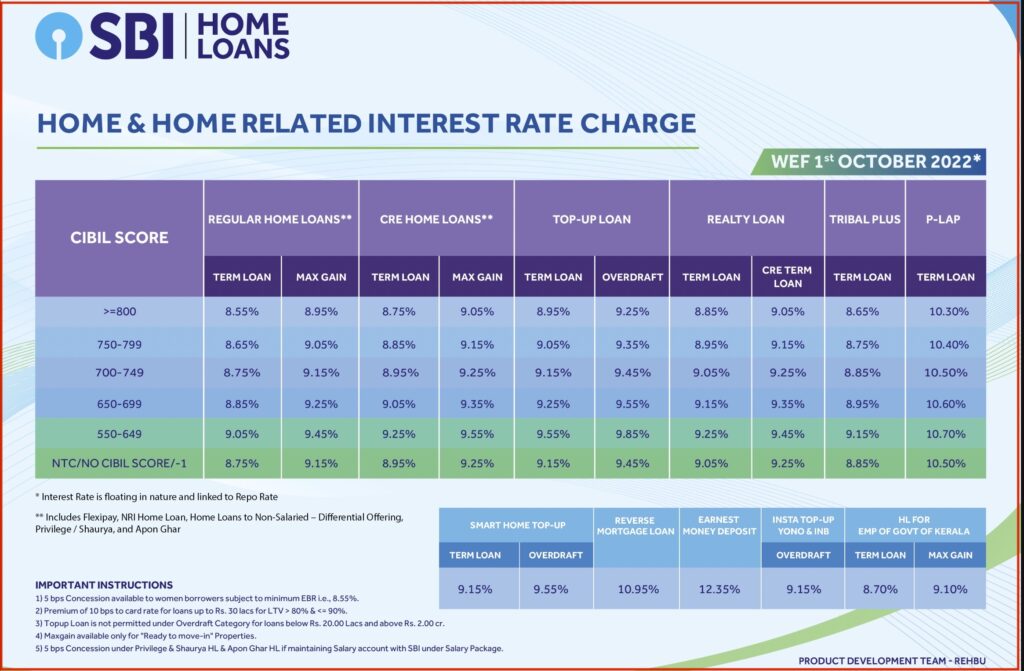

- Low Interest Rate – If any defense person takes SBI Shaurya Home Loan, then he has to pay 0.05% less interest. For example, if the interest rate of a normal home loan is 8.55%, then under Shaurya Home Loan, the defense person pays 8.50% loan interest. For your information, let us tell you that SBI home loan interest rates are floating. That is, according to the repo rate of RBI, interest rate keep on changing from time to time. For your convenience, the latest SBI Bank home loan interest rates are shown below. As you can see in the photo below that interest rate are varying on the basis of CIBIL SCORE. If your CIBIL SCORE is good then you can get up to 1% discount in interest rate. We will discuss in details about CIBIL SCORE in the next post.

- Zero Processing Fee - SBI Bank does not charge a processing fee for Shaurya Home Loan. Processing fees generally range from 0.30% to 0.70% of the loan amount. It is different for all banks. For example, if we assume the processing fee to be 0.40%, then you can save Rs.8000 on a loan of 20 lakhs with Shaurya Home Loan. But the defense person has to pay the advocate fee for property search, stamp duty for loan agreement. SBI bank does not charge any processing fee from the SBI DSP account holders.

- No Hidden Fees - SBI Bank claims that the bank does not charge any hidden fees under Shaurya Home Loan. Whenever one takes a home loan from the bank, there are some charges which are not mentioned at the time of taking the loan but are charged later. They are commonly called hidden fees. These mainly include Home Loan Processing Fee, Home Loan Administration Fee, Stamp Duty & Registration Charge, GST on Home Loan, Legal Assessment Fee for Property, Documentation Charge, Credit Score Report Charge, Home Loan Duration Change Fee, EMI Late Payment Penalty, Home loan prepayment charges, cheque bounce charges, home loan incidental charges etc. Before taking a loan, you must ask the loan officer whether these charges are to be paid under Shaurya Home Loan or not. If need to pay then how much?

- No Prepayment Penalty - Prepayment charges are to be paid at the time you pay off the home loan before the completion of the tenure. For example, if the defense person has taken a Shaurya Home Loan of Rs 20 lakh for 20 years. But if he pays off the loan in 5 years instead of 20 years, then he does not have to pay the prepayment charges. This too is a hidden charge. But SBI does not charge any prepayment under Shaurya Home Loan. For your information, let us tell you that SBI Bank does not charge prepayment for any home loan. Not only SBI, most banks do not charge prepayment for home loans.

Interest is charged on the basis of daily balance – If you make bulk payments during the tenure of the loan, then interest is charged only on the balance amount. By the way, SBI Bank also provides this facility in other home loans.

- Repayment time up to 30 years - Banks generally offer a maximum repayment time of 20 years for home loans. But in Shaurya Home Loan, the defense person gets a maximum tenure of 30 years. By the way, due to the payment of loan for a long time, only the defense person suffers.

- Interest Waiver for Women – If a woman who is a Defense Person and takes Shaurya Home Loan, then she gets an additional concession of 0.10% in interest rates.

Shaurya Home Loan Amount

The maximum loan amount defense person can get depends on two things.

- Salary

- House's construction cost

All banks give any loan based on salary. Your net salary is taken into account while calculating the loan amount. Apart from this, it is also checked whether any other EMI is going from your account. After that the loan amount is calculated. Banks offer loans up to 80% of the house construction cost or the value of the apartment. Loans are done on the basis of both these conditions.

In an upcoming post, We will talk about the Shaurya home loan process and the required documents. To share this news on whatsapp, you can share by clicking on the share button given at the beginning of the post.